Bank NEFT or RTGS Application Form" width="703" height="352" />

Bank NEFT or RTGS Application Form" width="703" height="352" />NEFT stands for National Electronic Funds Transfers and RTGS stands for Real-Time Gross Settlement. Both of these systems are used to make funds transfer or money transfers. But they are not one and the same. There is a difference in NEFT and RTGS which I will be talking about in a while. On this page, you will find the download link of ICICI Bank NEFT and RTGS Form in PDF Format.

To download ICICI Bank NEFT and RTGS form the customer has to visit the official website of ICICI Bank. Go to the forms section and select NEFT and RTGS form. And the download of the form in PDF format will begin shortly. The download link provided below on this page can also be used to download the form.

It is an application form that you have to fill if you want to make funds transfers using NEFT or RTGS system from the branch of ICICI Bank. You can obtain this form both in electronic form online (PDF Format) and in printed form from the branch where you wish to make the transfer.

Bank NEFT or RTGS Application Form" width="703" height="352" />

Bank NEFT or RTGS Application Form" width="703" height="352" />

Both these systems help us to make funds transfers but RTGS is used when someones want to make a transaction of Rs. 2,00,000 and above. And the NEFT system is mostly used when someone wants to make a transaction of value less than Rs. 2,00,000

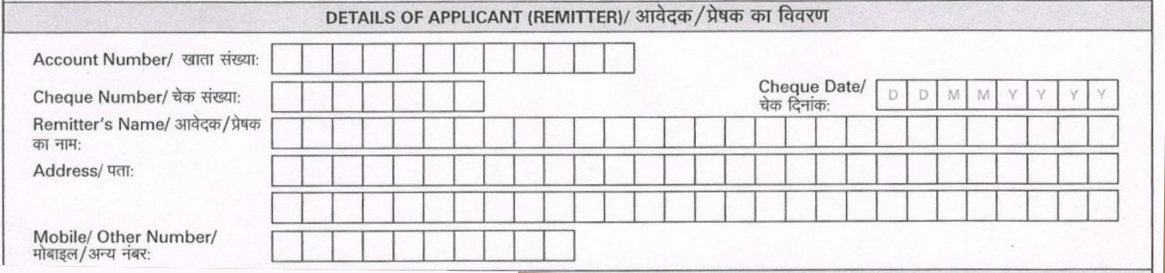

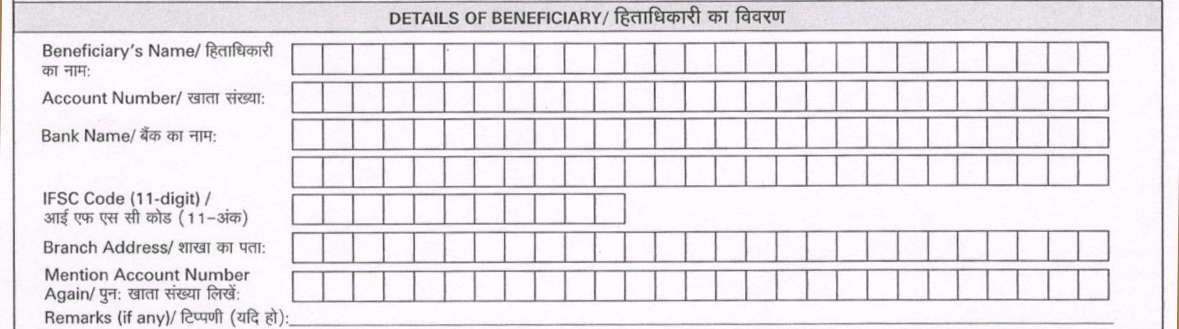

There are two sections in ICICI Bank NEFT or RTGS Form and they are, Details of Applicant (remitter) and Details of Beneficiary.

Bank NEFT or RTGS Form" width="1165" height="273" />

Bank NEFT or RTGS Form" width="1165" height="273" />

While filling the form you have to fill the below-mentioned details of the applicant in the form.

Bank NEFT or RTGS Form" width="1179" height="329" />

Bank NEFT or RTGS Form" width="1179" height="329" />

This section of the form should be used to fill the details of the beneficiary to whom you want to transfer the money.

Other than these two sections there is one more which is the top part where you have to fill the details like your name, account number, and how you would like to deduct the money from your bank account, etc.

If you do NEFT Transfer using the online modes like internet banking, Mobile App, Mera Mobile app, and Pockets app there is no NEFT transaction charges applied.

| Transaction Amount | NEFT Charges |

| Up to Rs. 10,000 | Rs. 2.25 + GST |

| Above Rs. 10,000 to Rs. 1,00,000 | Rs. 4.75 + GST |

| Above Rs. 1,00,000 to Rs. 2,00,000 | Rs. 14.75 + GST |

| Above Rs. 2,00,000 to Rs. 10,00,000 | Rs. 24.75 + GST |

There are no RTGS transaction charges applied to you if you do it using Internet Banking, iMobile app, Mera iMobile app, and Pockets app.

| Transaction Amount | RTGS Charges |

| Above Rs. 2,00,000 to Rs. 5,00,000 | Rs. 20 + GST |

| Above Rs. 5,00,000 to Rs. 10,00,000 | Rs. 45 + GST |

Conclusion

So this is how you can download the ICICI Bank NEFT Form and ICICI Bank RTGS Form in PDF format. The charges on the transaction are applied only when you do the transfer from the branch of the bank. If you want to save the charges then you can use the modes like Internet Banking and Mobile banking of the bank to transfer money.